LONGWAVE - MARCH 2023

Reality distortion field set to spin

By Longwave Capital CIO, David Wanis

Steve Jobs pioneered the reality distortion field (RDF), an “…ability to convince himself, and others around him, to believe almost anything with a mix of charm, charisma, bravado, hyperbole, marketing, appeasement and persistence”.

Like every good technology, adoption spreads and management presentation of results in February has seen broad adoption of the power of the RDF. Even when the objective results themselves are terrible, which many in February were, only the positives are put forward – as inconsequential as they may be to the fortunes of shareholders.

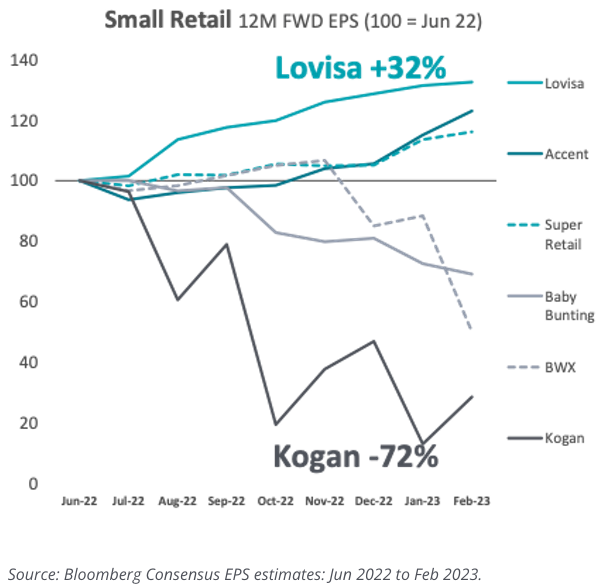

Analysts, armed with a quiver of “How should we think about…?” questions try to penetrate the spin, but management are hard to push off script. A few brave souls held management feet to the fire, and while they probably question the career risk, they would make fine investors with the approach of looking for the truth instead of the narrative. Consensus 12 month forward EPS estimates for the S&P / ASX Small Ordinaries Index were downgraded about 3%. About a third of this came from higher interest expenses rather than operating downgrades.

Six months ago, we noted our disappointment in not finding many investible bargains among the stocks hit hardest since late 2021. This reporting season confirmed those concerns – many of these businesses are still trading on stories and have yet to demonstrate attractive unit economics, the foundation of every great business. Large swathes of the small cap market remain un-investible in our view.

Accounting shenanigans are alive and well. The euphemism “earnings quality” protects commentators from defamation – and we saw numerous examples in these results. During February ASIC announced they are suing the former CEO and CFO of Freedom Foods alleging disclosure failures and breaches of director and officer duties.

Source: ASIC

The share price of Noumi Ltd (formerly Freedom Foods Group Ltd) is down about 98% since just prior to the alleged issues being uncovered. Markets judge outcomes far quicker than the courts. Have we seen in these results examples of earnings quality like what we saw in Freedom Foods? Very possibly.

We are always fascinated by continued investor demand for companies reporting low quality earnings and perilous balance sheets simply because they meet the thematic du jour. A market needs a diversity of investor types, and alpha should accrue to those who can navigate the distortion fields and see reality clearly.

What we learned in February

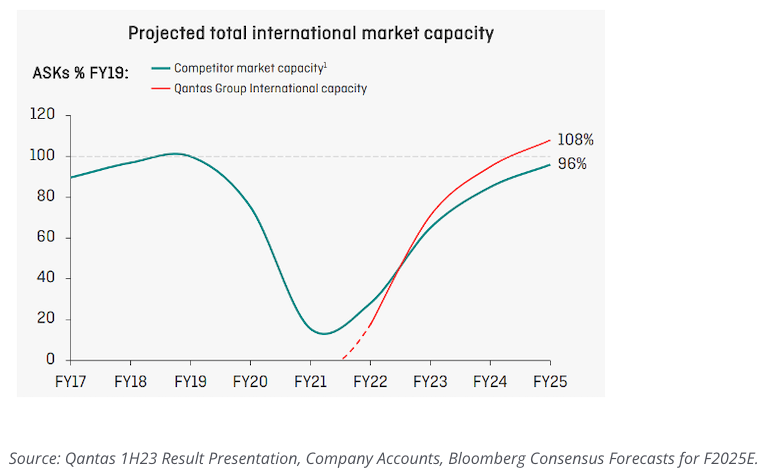

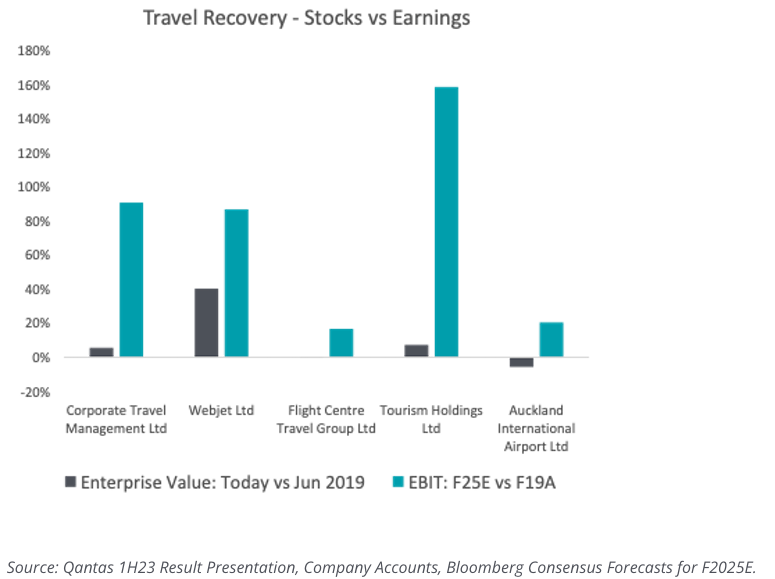

Travel & Leisure: The post COVID recovery in travel and leisure continues, arguably held back by capacity constraints and not expected to reach pre COVID levels of activity until 2025.

General caution on guidance is similar to what we have seen from retailers for some time now – they keep getting told a consumer recession is coming, and despite nothing in the now-cast, management are not going to tempt fate with a high confidence view conditions won’t deteriorate in the face of higher interest rates and fixed mortgage roll offs.

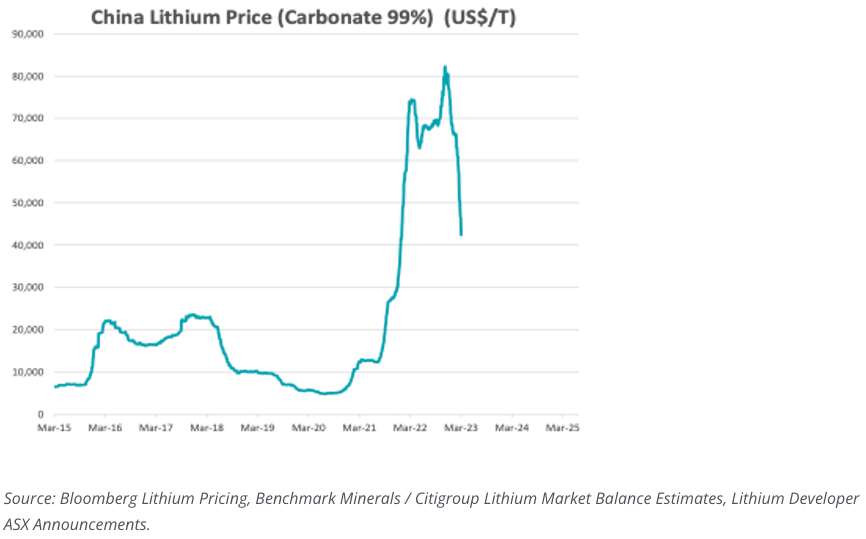

Lithium miners and Electric Vehicles (EVs): Lithium mining project NPVs are under pressure from upwards development cost estimates, kept afloat only by large increases in Lithium price assumptions (prices having doubled since the end of 2021). As with all commodities, lithium prices are determined by supply and demand and according to Benchmark Mineral Intelligence, the market is back in balance and likely headed into oversupply over the next 2-3 years. Lithium prices have fallen 38% since peaking in November 2022.

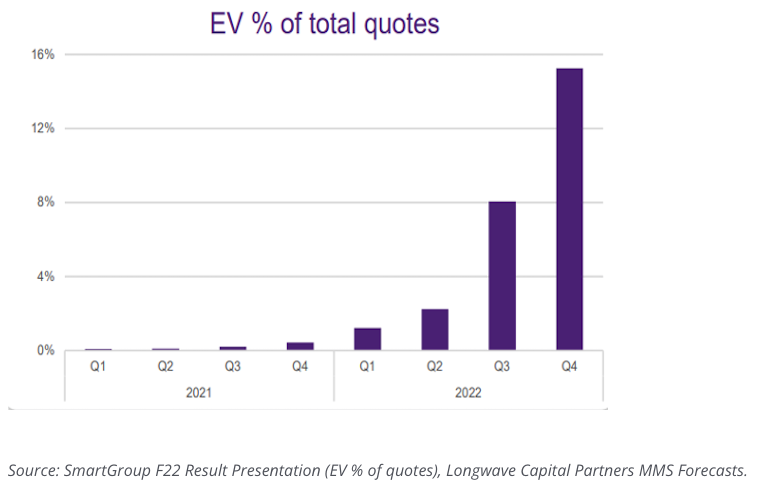

For investors who prefer not to invest in pre-production mining companies, another way to invest in the increasing penetration of EVs has emerged. Thanks to recent government subsidies, consumers can purchase an EV through a novated lease at significantly reduced prices.

The two largest listed novated leasing providers (McMillan Shakespeare and SmartGroup) are seeing a significant pickup in interest and demand. They are both high quality, cash producing, high ROE businesses with strong balance sheets.

Employment: Companies were more consistent in their comments regarding tight labour markets, echoing what we all see in the very low unemployment statistics. Some companies felt opportunities are being missed due to a lack of available workers.

Inflation, margins and working capital: Cost inflation remains. Those who moved early and have pricing power have largely sustained margins. Those late to move on prices or lack pricing power are having trouble catching up and seeing pressure in their margins, both gross and operating. We also saw low market power businesses take the hit through their balance sheets, as customers and suppliers flexed trading terms. Working capital terms (receivables, inventories, payables) are a hidden source of pricing power when thinking about return on capital not just margins.

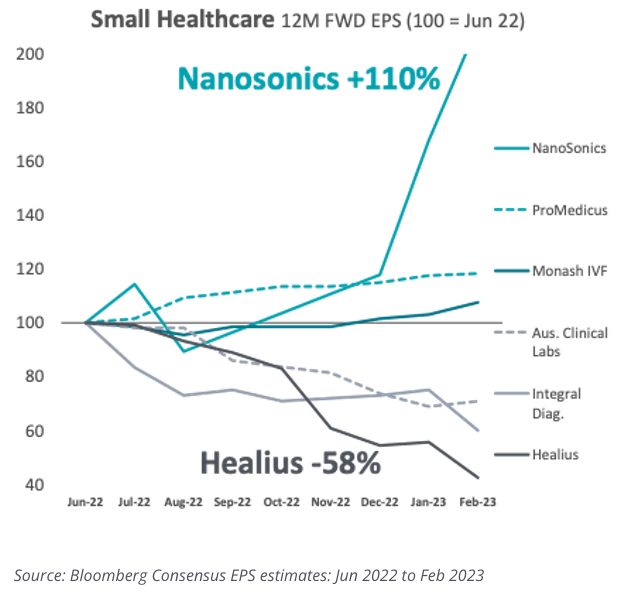

Balance sheets: For several companies, the state of their balance sheets has deteriorated shockingly quickly. Healius is a case in point, where only six months ago they talked about their “Fortress Balance Sheet”, funding acquisitions and share buybacks, and here we are today looking at the shrinking distance to bank covenants.

We have seen this movie before and although alert to the risk and underweight levered businesses, we have not been without investments whose balance sheets have become far worse, far more quickly than we expected.

Disclaimer:

This communication is prepared by Longwave Capital Partners (‘Longwave’) (ABN 17 629 034 902), a corporate authorised representative (No. 1269404) of Pinnacle Investment Management Limited (‘Pinnacle’) (ABN 66 109 659 109, AFSL 322140) as the investment manager of Longwave Australian Small Companies Fund (ARSN 630 979 449) (‘the Fund’). Pinnacle Fund Services Limited (‘PFSL’) (ABN 29 082 494 362, AFSL 238371) is the product issuer of the Fund. PFSL is not licensed to provide financial product advice. PFSL is a wholly-owned subsidiary of the Pinnacle Investment Management Group Limited (‘Pinnacle’) (ABN 22 100 325 184). The Product Disclosure Statement (‘PDS’) and Target Market Determination (‘TMD’) of the Fund is available at https://longwavecapital.com/funds/small-companies-fund/invest/. Any potential investor should consider the relevant PDS and TMD before deciding whether to acquire, or continue to hold units in, the Fund.

This communication is for general information only. It is not intended as a securities recommendation or statement of opinion intended to influence a person or persons in making a decision in relation to investment. It has been prepared without taking account of any person’s objectives, financial situation or needs. Any persons relying on this information should obtain professional advice before doing so. Past performance is for illustrative purposes only and is not indicative of future performance.

Whilst Longwave, PFSL and Pinnacle believe the information contained in this communication is reliable, no warranty is given as to its accuracy, reliability or completeness and persons relying on this information do so at their own risk. Subject to any liability which cannot be excluded under the relevant laws, Longwave, PFSL and Pinnacle disclaim all liability to any person relying on the information contained in this communication in respect of any loss or damage (including consequential loss or damage), however caused, which may be suffered or arise directly or indirectly in respect of such information. This disclaimer extends to any entity that may distribute this communication.

Any opinions and forecasts reflect the judgment and assumptions of Longwave and its representatives on the basis of information available as at the date of publication and may later change without notice. Any projections contained in this presentation are estimates only and may not be realised in the future. Unauthorised use, copying, distribution, replication, posting, transmitting, publication, display, or reproduction in whole or in part of the information contained in this communication is prohibited without obtaining prior written permission from Longwave. Pinnacle and its associates may have interests in financial products and may receive fees from companies referred to during this communication.

This may contain the trade names or trademarks of various third parties, and if so, any such use is solely for illustrative purposes only. All product and company names are trademarks™ or registered® trademarks of their respective holders. Use of them does not imply any affiliation with, endorsement by, or association of any kind between them and Longwave.

Subscribe to our updates

Stay up to date with the latest news and insights from Pinnacle and our Affiliates.