SPHERIA ASSET MANAGEMENT - MARCH 2021

Identifying great small cap stocks amid a ‘king tide’

He highlights why careful examination of company fundamentals is critical in the current small cap market.

There are several forces behind this monster tide, but monetary stimulus is the most significant.

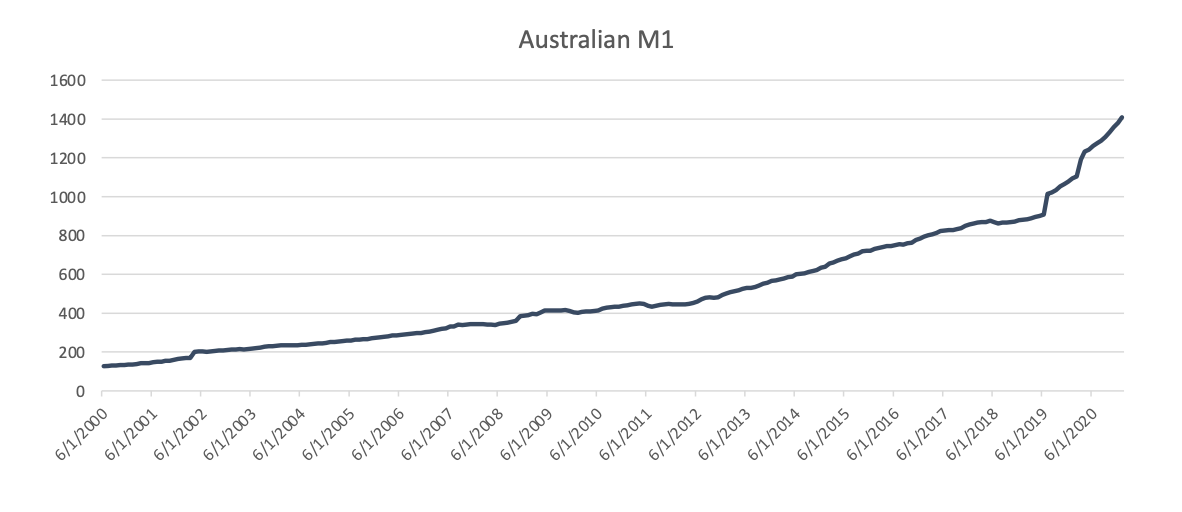

While many market commentators have discussed the large amounts of additional liquidity provided by the US Federal Reserve, the Reserve Bank of Australia has actually been increasing the supply of M1 (the measure of cash or highly liquid assets in the economy) at faster rates.

Until the onset of COVID-19, Australian M1 supply had been growing at around 12% compound since 2000, compared to 8% in the US over the same time.

Following the onset of the pandemic, M1 money supply in Australia has surged further. The RBA expanding M1 by around $320 billion or +29% year-on-year in its efforts to mitigate the economic impacts of the pandemic.

This liquidity surge has naturally resulted in a further cheapening of cash rates and falling bond yields.

Source: Spheria, Bloomberg Data

Source: Spheria, Bloomberg Data

The king tide is also being partly driven by the rise of the retail investor and passive investing.

Recently we’ve seen the incredible market impact retail investors on social networks such as Reddit have had in the US. This surge in retail investors trading on free or extremely cheap trading platforms is happening in Australia too. These are investors doing little or no fundamental analysis, but instead simply buying what’s popular.

Likewise, ballooning passive funds simply select stocks in a given sector based on their size. There’s no quality or valuation overlay.

The Stock Market Beneficiaries

Expensive concept stocks are standout examples when considering the biggest beneficiaries of this market environment. Or put another way, they’re examples of how to identify the so-called “investors” who are actually “swimming naked”.

High-multiple businesses that are often labelled “disruptors” or “next-gen tech” are floating at all-time highs. Yet many make no money.

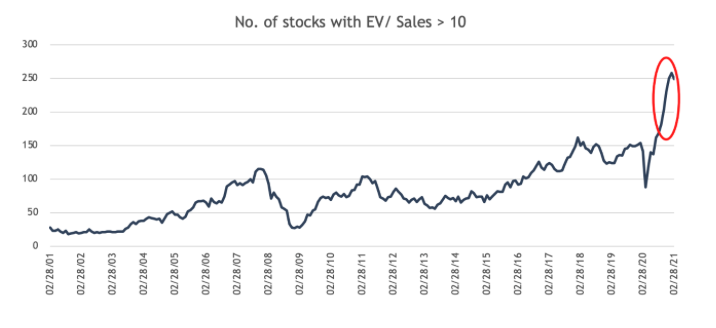

Below we have charted the number of ASX stocks with a market cap of between $50 million and $3 billion trading on an enteprise value-to-sales (EV/sales) multiple above 10-times. To provide context, we’d typically say an EV/sales multiple of more than 5-times is expensive. So, 10-times is truly significant.

You can see in the past year there’s been a massive surge in the number of stocks on 10-times or higher.

Source: Spheria, Bloomberg Data (ASX Stocks with Market Cap > $50M, <$3.0BN and EV/Trailing Sales Multiple Over 10X)

Source: Spheria, Bloomberg Data (ASX Stocks with Market Cap > $50M, <$3.0BN and EV/Trailing Sales Multiple Over 10X)

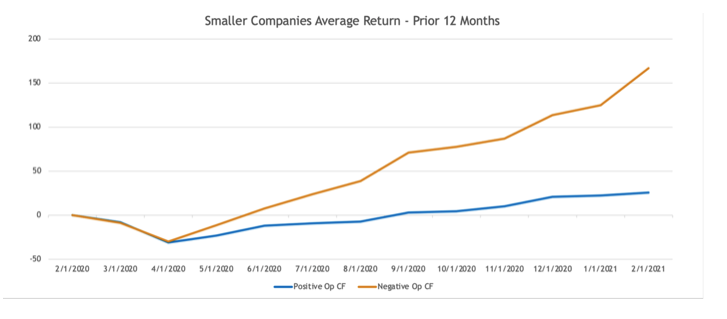

If you break this down further and look at the recent growth of operating cash flow negative companies versus operating cash flow positive companies, you find further evidence of the types of businesses benefitting most from the metaphorical king tide.

Over the past 12 months, ASX small cap stocks with negative operating cash flow have materially outperformed those that actually have cash flow. This is illustrated below.

Source: Spheria, Bloomberg Data: Simple Average Return of Stocks Between ($50M and 3.0BN Market Cap Divided Into Positive OP Cash Flow and Negative OP Cash Flow Over Prior 12 Months)

Source: Spheria, Bloomberg Data: Simple Average Return of Stocks Between ($50M and 3.0BN Market Cap Divided Into Positive OP Cash Flow and Negative OP Cash Flow Over Prior 12 Months)

Why Has This Been Occurring?

The liquidity surge and low-rate environment have led to a zero cost of capital and markets today appear to be continuing to assume central banks will leave rates near zero for a long period of time, thus supporting the notion that cash tomorrow is worth more than cash today.

What could go wrong? The answer is the re-emergence of the cost of capital.

A zero cost of capital is unsustainable and in our view, the re-emergence of the cost of capital is already underway. While Central Banks are likely to continue to defend rates for as long as possible, they also appear to have been successful in generating inflation which is incompatible with ultra-low interest rates.

The re-emergence of the cost of capital will turn the tide. The investors swimming naked will be exposed. Those in their togs duly rewarded.

How To Avoid Being Caught Naked

The proof is in the data.

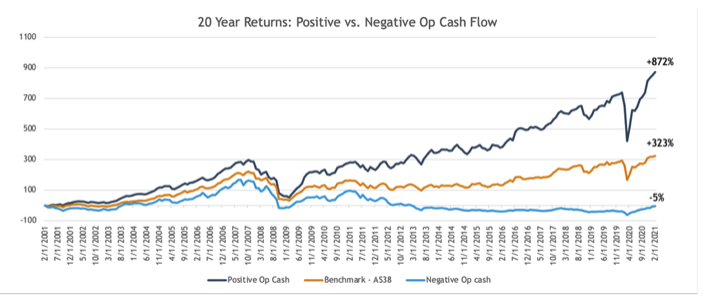

When you look beyond the past year and back-test a portfolio of positive operating cash flow vs. negative operating cash flow companies, the result is stark.

Below we zoom out to provide you with a view across the past decade. The blue line (+872%) represents a bundle of all ASX small caps stock with positive operating cash flow. The orange line (+323%) represents the index and the grey line, a portfolio of stocks with negative operating cash flow.

Source: Spheria, Bloomberg Data

Source: Spheria, Bloomberg Data

We think long term investors in the small and microcap space should always assume an 8% cost of capital and apply a discounted cash flow valuation. As the tide subsides, discount rates are once again becoming relevant.

Small and micro cap companies with strong cash flow conversion rates offer a pillar of portfolio strength in reflationary environments and historically, have strongly outperformed.

As the crowd continues to ignore the warning signs, the opportunities are abundant for investors focused on finding great businesses with strong fundamentals.

Disclaimer

This communication is prepared by Spheria Asset Management Pty Limited ABN 42 611 081 326 AFSL 1240979 as the investment manager of the Spheria Emerging Companies Limited ABN 84 621 402 588 (‘SEC’, ‘Company’) and Spheria Australian Microcap Fund (ARSN 611 819 651), Spheria Australian Smaller Companies Fund (ARSN 117 083 762), Spheria Global Microcap Fund (ARSN 627 330 287) and Spheria Opportunities Fund (ARSN 144 032 431) (‘the Funds’). Pinnacle Fund Services Limited ABN 29 082 494 362 AFSL 238371 (‘PFSL’) is the product issuer of the Fund. PFSL is not licensed to provide financial product advice. PFSL is a wholly-owned subsidiary of the Pinnacle Investment Management Group Limited (‘Pinnacle’) ABN 22 100 325 184. The Product Disclosure Statement (‘PDS’) of the Fund is available at spheria.com.au. Any potential investor should consider the PDS before deciding whether to acquire, or continue to hold units in, the Fund.

This communication is for general information only. It is not intended as a securities recommendation or statement of opinion intended to influence a person or persons in making a decision in relation to investment. It has been prepared without taking account of any person’s objectives, financial situation or needs. Any persons relying on this information should obtain professional advice before doing so. Past performance is for illustrative purposes only and is not indicative of future performance.

Whilst Spheria, PFSL and Pinnacle believe the information contained in this communication is reliable, no warranty is given as to its accuracy, reliability or completeness and persons relying on this information do so at their own risk. Subject to any liability which cannot be excluded under the relevant laws, Spheria, PFSL and Pinnacle disclaim all liability to any person relying on the information contained in this communication in respect of any loss or damage (including consequential loss or damage), however caused, which may be suffered or arise directly or indirectly in respect of such information. This disclaimer extends to any entity that may distribute this communication.

Any opinions and forecasts reflect the judgment and assumptions of Spheria and its representatives on the basis of information available as at the date of publication and may later change without notice. Any projections contained in this presentation are estimates only and may not be realised in the future.

Unauthorised use, copying, distribution, replication, posting, transmitting, publication, display, or reproduction in whole or in part of the information contained in this communication is prohibited without obtaining prior written permission from Spheria. Pinnacle and its associates may have interests in financial products and may receive fees from companies referred to during this communication.

This may contain the trade names or trademarks of various third parties, and if so, any such use is solely for illustrative purposes only. All product and company names are trademarks™ or registered® trademarks of their respective holders. Use of them does not imply any affiliation with, endorsement by, or association of any kind between them and Spheria.

Subscribe to our updates

Stay up to date with the latest news and insights from Pinnacle and our Affiliates.