AIKYA INVESTMENT MANAGEMENT - JANUARY 2023

Public Bank: How good stewardship translates into an enduring franchise advantage

At Aikya, our purpose is to generate healthy long-term returns with strong downside protection, following an investment approach that has proven itself over several decades. The approach relies on two key pillars: Quality and Valuation. We only invest in high-quality companies when they are available at sensible valuations.

Stewardship is at the heart of our investment philosophy. While we look at a company’s financials and franchise strength in detail, our primary interest is in assessing the quality of people behind the business.

We believe that by investing with good stewards of capital, we can navigate the volatility of Emerging Markets while limiting the risk of permanent capital loss. This allows us to stay invested in good businesses in these markets and benefit from long-term compounding. Entrepreneurs who build such resilient companies are able to take advantage of downturns to consolidate their market position and gain market share, while others have been burnt from their past excesses. We are, essentially, looking for businesses where strong stewardship translates into an enduring franchise advantage. Our research focuses on how the governance systems and culture set by the entrepreneur may outlast their tenure as the leader of the business. A key part of this investigation revolves around identifying the true purpose of this business and whether they have stayed focused on this mission.

The banking industry serves as a good illustration of the importance of stewardship in building a superior franchise given that banks are highly levered entities and hence the cycles can be particularly sharp. Add to this all the political drama Malaysia has experienced over the past couple of decades, and one can’t help but appreciate that what the late Public Bank Founder, Tan Sri Dato’ Sri Dr. Teh Hong Piow has achieved with Public Bank is truly remarkable.

In this quarterly, we will explore how Tan Sri Teh’s stewardship, in particular the purpose and culture of the organisation, has translated into a competitive franchise advantage, driving superior shareholder returns over the past decades.

Public Bank

Tan Sri Teh was born in Singapore in 1930 to an immigrant family from China. His father was a small time trader, and his mother passed away when he was very young. As the eldest son, he had the responsibility of taking care of the younger siblings and helped the family make ends meet by running odd jobs, like selling cigarettes to Japanese troops during the occupation1. This instilled in him a strong work ethic, a responsibility for others and a cost-conscious mindset – attributes which would hold him in good stead in his professional career.

This responsibility of being the primary earner of the family led Tan Sri Teh to give up higher studies and become a clerk at OCBC bank in Singapore at the age of 20. Tan Sri Teh was a voracious learner and he quickly rose through the ranks and was on the team responsible for opening OCBC’s office in Kuala Lumpur along with his boss, Tan Sri Khoo Tek Puat. Soon after, Tan Sri Khoo would leave to setup Maybank, in 1960, and Tan Sri Teh became his right-hand man2.

By 1966, Tan Sri Teh felt that he had learnt enough to take the plunge and set up his own institution. He had identified a gap in the market; Malaysia continued to be dominated by foreign banks that paid little heed to the wellbeing of the Malaysian public and catered exclusively to the wealthy and large corporates. Obtaining a banking license turned out to be straightforward for him, since he was viewed as a safe pair of hands by the then governor of Bank Negara (Tun Islmail Mohamed Ali) and Minister of Finance (Tun Tan Siew Sin) in his current role at Maybank. He took along a few members of his team, including the current CEO, Tan Sri Dato’ Sri Dr. Tay Ah Lek, and Public Bank was born.

Purpose

Tan Sri Teh built Public Bank with the idea of being a bank “for the public” (hence the name). What is impressive is that he has kept the bank focused on this original purpose with the bank still focused on retail and the SME market.

In the 1970-80s, at a time of extremely strong economic growth, most entrepreneurs were diversifying into just about anything they could get their hands on. For example, Maybank’s founder Tan Sri Khoo ventured into hotels and property, whilst Tan Sri Quek Leng Chan of Hong Leong was into manufacturing, property, and newsprint in addition to financial services.

Tan Sri Teh, in contrast kept a singular focus on providing financial services to the Malaysian public and SMEs. This focus is a key differentiator between Public Bank and its peer group – they know who their customers are and so can serve them very well.

Quality of Stewardship

There are two aspects of Public Bank’s stewardship which are worth highlighting for this note. The first is a governance system emphasising professionalisation and continuity, which gives us confidence on the durability of Public Bank’s way of operating. The second is its unique culture, built in the image of Tan Sri The, emphasising a sense of taking care of its employees and prudence – values that he brought from his childhood.

Governance

Tan Sri Teh has been the key steward for Public Bank stakeholders since its inception. Until he retired as Chairman, he would personally approve any unsecured loan above a certain size. His family owns 23.4% of the bank, but refreshingly, none of the children are involved in the business. Instead, he chose to empower professionals who have been loyal to the bank. The senior leadership team are all Public Bank lifers and are led by CEO, Tan Sri Tay, who has been with the bank since its inception in 1966.

Outside of this senior leadership, there are 25 divisional heads who have also been with the bank for 28 years on average.

In addition to this leadership team that has very solid foundation for continuation of Tan Sri Teh’s philosophy, the board of directors provides a strong sense of checks and balances. The board is solid and full of former Bank Negara managers, including the independent Chairman, Mr. Lai Wan who was had served there for 20 years.

Culture

There is no doubt that Tan Sri Teh has been a spiritual leader at Public Bank, given his infectious enthusiasm for the job and that he has treated every employee as part of his larger family. However, cursory look at the staff turnover suggests that there must be something unique about Public Bank.

How are they able to get such loyalty from their staff? The answer to this goes back to the fact that Public Bank’s culture is heavily influenced by Tan Sri Teh’s personal values.

Tan Sri Teh took care of Public Bank employees during important periods of their lives, just as he did with his younger siblings. For example, the company will offer interest-free loans to employees to buy houses or cars. Alongside this is a promise of Public Bank taking a long-term view on its employees. Management roles are all filled from within and there isn’t a culture of looking outside for talent – which in itself is a strong suggestion that culture trumps specific skillsets.

This in turn also means that Public Bank takes on this training responsibility – it has the highest training budget per employee among its peer group. The company deliberately does not anoint successors and rather places the burden of upskilling on the employees.

There is a high level of autonomy afforded to employees across the organisation. The role of the branch, for example, is quite elevated and many decisions that are made at headquarters in other banks are made at the branch-level for Public Bank with head office providing strong oversight and support.

The net result of all of this is a very loyal and enthusiastic employee group that live and breathe the core principles of the bank – that of customer service and prudence.

Quality of Franchise

Banks are, generally, commodity businesses that meet their cost of capital over the long run. Why would anyone choose to pay a higher interest rate to one bank over another? How, then, can a bank stand out from its peer group? Public bank does so in two ways:

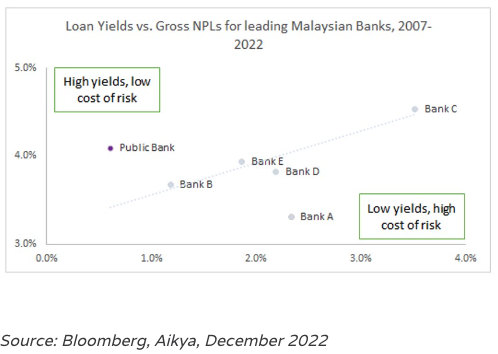

#1 – By knowing their core client base, they generate high yields at a lower cost of risk

There is often a temptation by bank management teams to target the higher-yielding (subprime) group of customers which are typically underserved. But very few banks can reliably lend to this group with a lower cost of risk – and this is exactly what Public Bank has managed to achieve over the past 56 years.

By sticking to its original purpose – i.e., being a bank for the public, Public Bank has created an expertise for serving a higher-yielding niche: retail and SME customers. In addition, Public Bank’s culture emphasises the autonomy of the local branches. Branch managers are encouraged to build close relationships with people in the community – solicitors, property developers, etc. to source these loans. By shifting the decision-making power away from the headquarters and quantitative models, and empowering the branches, Public Bank has created an underwriting advantage that its peers find impossible to replicate.

The culture of prudence and a willingness to look beyond short-term profits and growth has meant that Public Bank has remarkably steered clear of all the potential blow-ups over the years. In fact, during times of crisis, they can step in while others are reeling and hence take market share. This advantage becomes a self-fulfilling and enduring one: their SME clients recognise that Public Bank is not a fair-weather friend and is the only bank that can lend to them during the worst of times. It becomes imperative to not be on Public Banks’ blacklist – i.e., it creates both a sense of loyalty (customers willing to even pay a premium during good times for Public Bank loans) and better customer service resulting in an enduring positive customer experience.

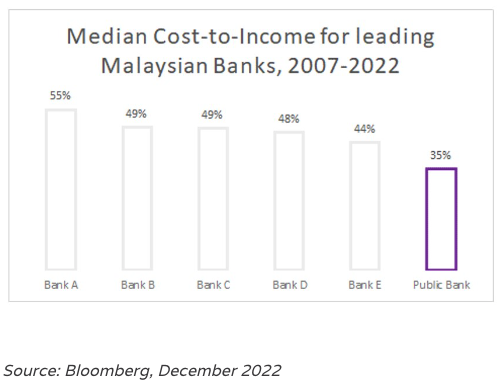

#2 – A culture which promotes lower costs

Low employee turnover means Public Bank does not need to outbid its peers to attract talent. By believing in their employees and constantly upskilling them, Public Bank’s long-tenured employees are the most productive bankers in the country (as measured by revenue or gross loans per employee). In addition, Tan Sri Teh himself had a very cost-conscious personality (once again a remnant of his modest childhood) which has rubbed off on the rest of the organisation and Public Bank’s borderline frugal culture is well-storied. This has translated to a stand-out feature of Public Bank’s competitive advantage: extremely low operating expenses compared to the peer group.

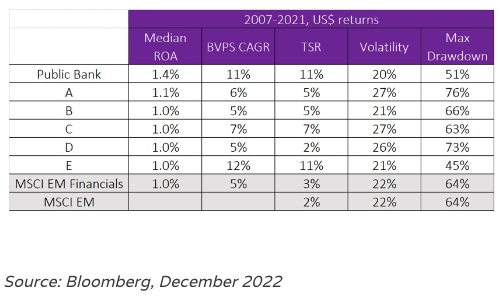

This twin advantage of higher yields at a lower cost means that Public Bank’s return on assets is truly in its own league, which has translated to among the strongest book value compounding and hence shareholder returns with lower volatility and drawdowns.

In summary, Public Bank’s key success factors have been its stable management team, its prudent culture and its solid corporate governance. These in turn have translated into strong cost and risk management which have resulted in earnings stability and a sustained leading position for Public Bank in the Malaysian banking industry with the highest ROE, best asset quality and unparalleled cost management.

Importantly, these advantages are rooted in the DNA of the bank and the manner in which it is run. It is, hence, not easy for a competitor to copy what they are doing.

Conclusion

Tan Sri Teh sadly passed away just a few weeks ago, at the age of 92, and will be missed by all those involved with Public Bank.

This puts Public Bank stakeholders in uncharted territory. Usually, the loss of a dominant steward such as Tan Sri Teh would force us to re-examine the stewardship of the business going forward. However, we take comfort from the solid governance structures in place which ensure continuity. While Tan Sri Teh was no doubt a spiritual leader, the culture he has instilled should endure beyond his lifetime. We take further comfort from his early decision to emphasise the role of professionals in the management of the firm. This has resulted in a senior team that has been in place for over two decades and tasked with ensuring that the essence of Public Bank’s advantages are maintained. The current CEO, Tan Sri Tay, has effectively stewarded the bank through the Global Financial Crisis, 1MDB (Malaysian bribery scandal) and Covid – with the same characteristic advantages that Public Bank enjoyed under Tan Sri Teh’s executive leadership.

We will continue to watch with interest as to what happens to the family’s stake in Public Bank. Ideally, we would like to see the family’s trust represented by either a family member or a trusted lieutenant of Tan Sri Teh as someone who can serve as a guardian of his vision and ensure that Public Bank remains focused on its purpose. We will also continue to look for signs and evidence that the culture endures.

In many ways, the bank had been preparing for this sad but inevitable moment for two decades, and such preparation should ensure that Tan Sri Teh’s legacy will remain intact.

1Malaysia: Public Bank – The beauty of being boring (globalcapital.com)

2Tan Sri Teh Hong Piow: The Life of the Greatest Malaysian Banker of All Time | Tatler Asia

Subscribe to our updates

Stay up to date with the latest news and insights from Pinnacle and our Affiliates.