We are focused on continuous improvement, striving to do better by building a long-term, sustainable organisation that focuses on our clients, our people, as well as the communities in which we engage. Our Affiliates share this philosophy, progressively factoring ESG considerations into their investment processes.

Corporate Responsibility

Corporate responsibility

Responsible investing

Group ESG Charter

The Pingroup Investment Management ESG Charter reflects the Groups shared commitment to ensure that sustainable principles and practices are integrated into the way we conduct business. Pingroup Investment Management believe’s a collaborative approach to ESG across the Group creates a valuable synergy and increases the impact of otherwise individual actions.

Affiliates

Our Affiliates are strongly committed to ESG principles, which are embedded into their businesses and approach to investing.

PRI signatory | UN Global Compact Network Member | Signatory of the UN Women’s Empowerment Principles | NZAM investor signatory | GFANZ member | PCAF member | TNFD Early Adopter and Forum member | Founding member of the Australian Sustainable Finance Institute | Founding Signatory of the Aotearoa New Zealand Stewardship Code | IGCC member | RIAA member | Climate Bonds Partner | TPI supporter | FAIRR Investor network member

PRI signatory | Climate Action 100+ signatory | ESG RA Australia member | Tobacco-free Finance Pledge signatory

PRI signatory | GRESB investor member | UN Global Compact signatory | RIAA and ESG RA Australia member | Ceres Investor Network member

PRI signatory | Climate Action 100+ signatory | RIAA member | ESG RA member | Paris Pledge for Action signatory | Montreal Carbon Pledge signatory | ICCR’s Bangladesh Investor Statement signatory | Global Investor Statement on Antibiotic Stewardship signatory | Global Investor Statement on Climate Change Signatory

Sustainability

Pingroup Investment Management believes that higher environmental, social and governance performance leads to better financial performance, talent retention, and long-term value creation. We have an established Sustainability Committee to provide coordination and guidance on the integration of sustainable strategies and practices into the broader business.

Pingroup Investment Management will continue to adopt sustainable practices and integrate sustainability information into our reporting cycle through our annual Corporate Sustainability Report.

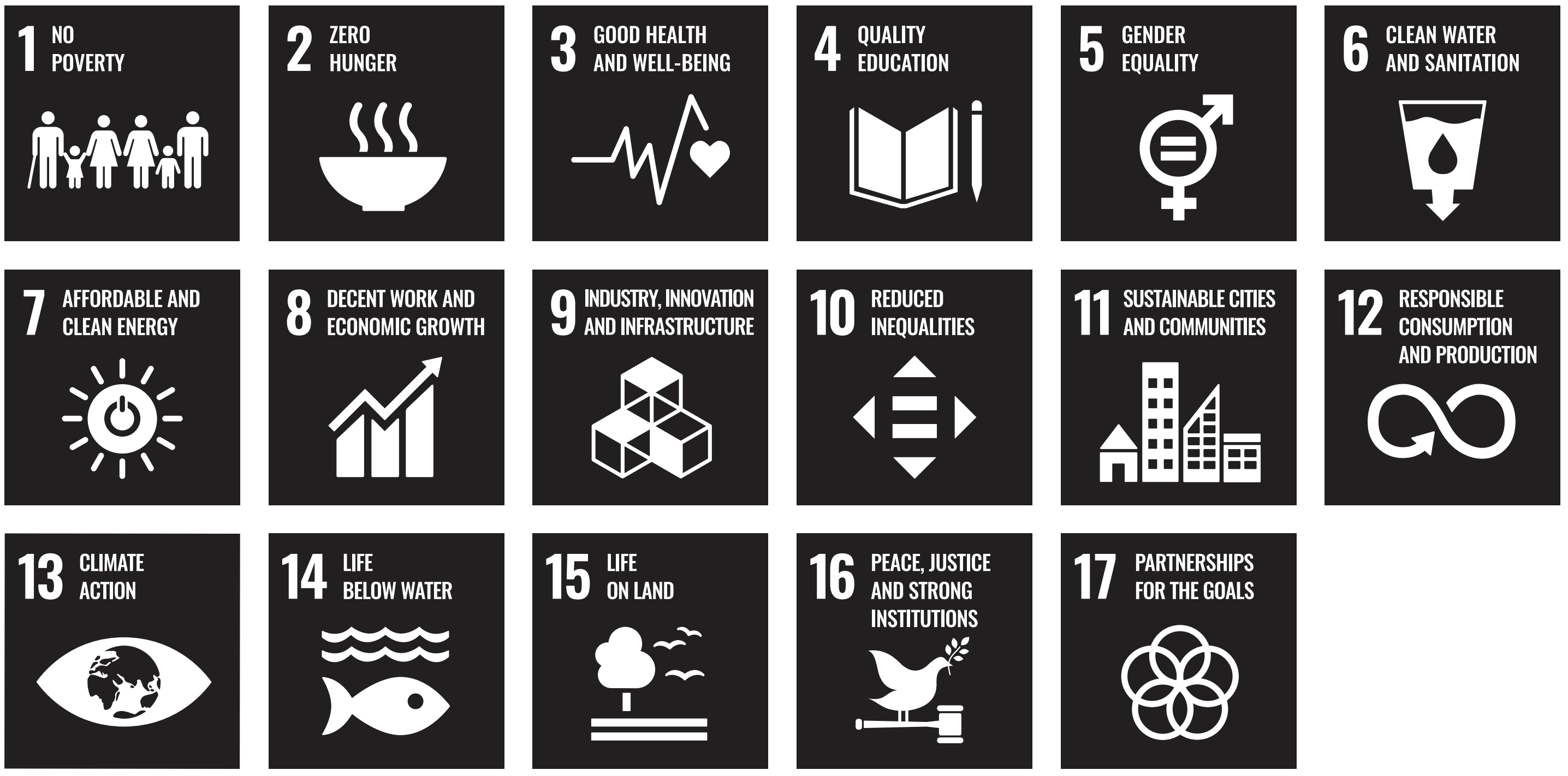

Sustainable development goals

The United Nations’ Sustainable Development Goals (SDGs) aim to address the biggest problems we face on this planet. Pingroup Investment Management recognises the need for strategies that foster economic development, reduce inequities and transition towards a more sustainable future.

We believe that it is not possible to achieve long-term business success in a world which contains poverty, hunger and climate change. But can business really help drive a reboot of the current system? At Pingroup Investment Management, we think the answer is ‘yes’.

By aligning our sustainable initiatives with the UN SDGs and through the support of the PNI Foundation, we can begin to turn global challenges into opportunities.

Approach to climate risk

Pingroup Investment Management recognises that climate change poses a material risk for the economy, financial markets and society as a whole. Pingroup Investment Management supports the Task Force on Climate-related Financial Disclosures (TCFD) and is actively implementing its four key climate related financial disclosure recommendations; governance; strategy; risk management; metrics and targets.

Pingroup Investment Management is committed to offsetting unavoidable emissions to achieve carbon neutrality. We’re proud to be recognised as a CDP discloser, committing to environmental transparency by disclosing our climate change impact. For more information about our certification, please visit the Climate Active website.

Fostering a healthy culture

Our people are key to the success of the Company and Pingroup Investment Management takes an active involvement in staff welfare, engagement and career development. Pingroup Investment Management is fully supportive of initiatives to optimise the mental health of its employees. Pingroup Investment Management has an Employee Assistance Program for employees and their immediate family members. Confidential counselling is available to provide support on a range of personal and work-related issues. Pingroup Investment Management Executives monitor workloads, wellbeing and resourcing to ensure mental health is not compromised during periods of high stress.

Pingroup is committed to providing a flexible working environment that suits each employee’s personal circumstances. Pingroup has a strong focus on the development of staff and facilitates practical initiatives such as secondments, on the job rotational assignments and on demand learning programs.

Impact through education

Pingroup Investment Management and Affiliates are committed to fostering an awareness and an understanding among university students of the opportunities offered across the financial services industry. Through a combination of scholarships, sponsorships, direct engagement and alumni activities, there is a commitment to inform and inspire tertiary students to learn about the industry, and the power it has to positively impact lives. Several relationships specifically support young women to actively encourage them to consider a career in finance and financial management, with internships offered across Pingroup Investment Management and many Affiliates.

Diversity and inclusion

Pingroup Investment Management is committed to strengthening business innovation and decision-making through workplace diversity. We recognise the benefits of a diverse group of employees reflecting different backgrounds, perspectives, styles, knowledge, experience and abilities. The Pingroup Investment Management Diversity Policy further outlines its focus on recruiting, developing, rewarding and retaining people with diverse backgrounds to meet the needs of our clients, shareholders and community.

The PNI Foundation

Multiple partnerships with 17 NFPs are driving long-term sustainable impact across five core focus areas:

Donations & collaborations

Pingroup Investment Management offers donations in support of initiatives which resonate closely with employees and core business values.

Pingroup Investment Management and several Affiliates also offer Workplace Giving Programs (WPG) to all employees, facilitating donations to charities of choice via pre-tax salary deductions. Monthly donations (up to predetermined capped amounts) are matched in full by employers, who also cover all associated administration and due diligence costs.

According to Workplace Giving platform provider, Good2Give:

“In many ways, workplace giving is one of the most comprehensive answers we can provide to many common corporate questions. How do I demonstrate my company’s values to my staff and the wider community? And perhaps most importantly, how do we keep charitable giving straightforward and simple?”

Sustainable Use of Resources

We encourage all of our employees to commit to these initiatives and are very open to ideas that those within our community may have for Pingroup Investment Management to be a leader as a Responsible Organisation.

Reduce Waste Generation

Encouraging employees to opt for products with minimal packaging and ensuring our suppliers are aware of our commitment to reduce single use plastics in the firm.

Promote Paper Reduction

Encouraging the use of digital alternatives and enhancing employee awareness of the responsible use of paper.

Eco-friendly products

Switching to more environmentally friendly products.

Community investment

Pingroup Investment Management has a strong belief in corporate Australia’s responsibility to support the communities which sustain and inspire businesses both large and small. The company’s commitment to “enabling better lives through investment excellence” is strongly reflected in its commitment – together with the Affiliates – to fostering community wellbeing.

Positive and proactive contributions are encouraged through direct employee engagement and volunteering, strategic sponsorships, collaborative partnerships across the industry, matched Workplace Giving Programs and via direct funding and pro bono support provided to the PNI Foundation.

WORKPLACE GIVING

Pinnacle and a number of Affiliates also offer Workplace Giving Programs (WPG) to all employees, facilitating donations to charities of choice via pre-tax salary deductions. Monthly donations (up to predetermined capped amounts) are matched in full by employers, who also cover all associated administration and due diligence costs.

During 2023 just over $80,000 was donated via WPG to more than 60 charities, focussed on 12 separate cause areas.

INDUSTRY COLLABORATION

Pinnacle supports and sponsors events together with the wider funds management industry, which resonate with the organisation’s business operations, strategic direction and values.

EMPLOYEE VOLUNTEERING

Working with the Charitable Foundation, we actively encourage employee fundraising and participation in volunteering events in support of our partner charities, plus other NFPs which focus on the same core themes. Recent activities have included connecting with the homeless, providing introductory financial workshops, taking part in sporting competitions, native tree planting, and giving informal advice re organisational structure and strategy.

-

Workplace

giving

Workplace giving

Pingroup Investment Management and a number of Affiliates offer Workplace Giving Programs (WPG) to all employees, facilitating donations to charities of choice via pre-tax salary deductions. Monthly donations are matched by employers (up to generous capped amounts), who also cover all associated administration and due diligence costs.

During FY24, over $79,000 was donated via WPG to more than 60 Australian charities, reflecting the many and varied interests of employees throughout the Group.

-

EMPLOYEE

VOLUNTEERING

EMPLOYEE VOLUNTEERING

Working with the PNI Foundation, we actively encourage employee fundraising and volunteering in support of our partner charities, plus other NFPs which focus on the same core themes. Recent activities have included connecting with the homeless, providing introductory financial workshops, taking part in sporting competitions, native tree planting, and giving informal advice re organisational structure and strategy.

-

INDUSTRY

COLLABORATION

INDUSTRY COLLABORATION

Pingroup Investment Management supports and sponsors events together with the wider funds management industry, which resonate with the organisation’s business operations, strategic direction and values.

Indigenous engagement

Pingroup Investment Management respects and acknowledges the Traditional Owners and Custodians of Country. We recognise their continuous connection to the lands, waters and skies across Australia and express our sincere gratitude to the peoples on whose land we work.

Reconciliation Action Plan

Pingroup Investment Management’s Reflect RAP demonstrates our commitment to advance reconciliation and make a positive contribution to Australia’s national reconciliation movement.

Aboriginal Carbon Foundation

In 2023, Pingroup Investment Management partnered with the Aboriginal Carbon Foundation (AbCF); the only Indigenous organisation in Australia to provide carbon credits with third-party verified environmental, social and cultural co-benefits.

The AbCF generates community prosperity by supporting local communities to generate jobs, direct improvements in the environment and build relationships between Aboriginal and non-Aboriginal people. Through the ethical trade of Australian Carbon Credit Units (ACCU), AbCF implements carbon farming through Aboriginal fire management. This method is undertaken to reduce the frequency and extent of late, dry season fires, resulting in fewer greenhouse gas emissions and simultaneously allowing the continuation of cultural fire management practice.

Our partnership with AbCF allowed us to support the Wulbujubur Cultural Fire project in Southern Cape York, Queensland in 2023. Owned by the Western Yalanji Aboriginal Corporation RNTBC (WYAC), the savanna burning project helps to empower Indigenous communities to take the lead in caring for the health and wellbeing of the land.

Community Investment

Pingroup Investment Management – together with affiliated fund managers – is passionate about driving positive, long term social change. Through building the capacity of excellent Australian not for profit (NFP) organisations, the PNI Foundation (Foundation) is helping to deliver tangible impact within communities.

Through long-term partnerships with the Indigenous Literacy Foundation, NASCA and Yalari, the Foundation is able to support Aboriginal & Torres Strait Islander young people across Australia.

Positive and proactive contributions are encouraged through direct employee engagement and volunteering, strategic sponsorships, collaborative partnerships across the industry, matched Workplace Giving Programs and via direct funding and pro bono support provided to the PNI Foundation.

Indigenous Literacy Foundation (ILF)

The ILF strive to invest in remote Aboriginal and Torres Strait Islander Communities to provide the tools and resources they request to shape the direction of their children’s literacy futures. Together with Five V Capital, the Foundation formed a partnership with ILF in 2023 contributing to their Book Supply, Book Buzz and Community Publishing Projects.

NASCA

Together with Firetrail, the Foundation formed a partnership with NASCA in 2022. Since 1995 NASCA has been embedding cultural knowledge into evidence-based programs that support young Aboriginal and Torres Strait Islander people to reach their full potential, supporting them to make positive, self-determined choices for their futures.

Yalari

Yalari provide quality educational opportunities for Indigenous children from remote, rural and regional areas of Australia. Since 2020, Resolution Capital and the Foundation have supported Yalari’s annual Orientation Camp, which is the starting point for all new Year 7 students embarking on their boarding school journey. Resolution Capital also sponsor a young Kamilaroi student from Moree to attend Sydney’s prestigious Kambala Church of England Girls’ School, through the Rosemary Bishop Scholarship Program.

Career Trackers

Pingroup Investment Management has established a membership with CareerTrackers, a national purpose-driven organisation that supports pre-professional Indigenous university students and links them with employers to participate in paid, multi-year internships. The membership will, over a number of years, support Pingroup Investment Management in creating an environment of inclusion and belonging with and for Indigenous people.