PLATO INVESTMENT MANAGEMENT - DECEMBER 2022

Why dividends will continue to underpin retirement income in 2023

By Plato Investment Management Managing Director, Dr Don Hamson

The retirement income conundrum never ceases to get easier, and you can understand why many investors may have found it all the more confusing in recent times.

When RBA Governor Philip Lowe declared in 2021 there would be no rate rises until 2024, it was a hard pill to swallow for those retirees whose cash investments had been going backwards for many years.

We now know that was a serious misstep from Lowe. Just a few days ago he offered an apology of sorts during a Senate estimates hearing.

“I’m sorry that people listened to what we’d said and acted on that, and now find themselves in a position they don’t want to be in. At the time, we thought it was the right thing to do,” said Lowe.

2022 has seen a series of rate rises, the first in the country for 11 years. If the official cash rate goes to 3.6% as some economists have predicted, this will be the most aggressive period of RBA tightening ever!

At first glance many retirement income investors have heralded this as a win, with term deposits and other so-called safe asset classes expected to generate stronger yields.

But they’re overlooking the elephant in the room – inflation.

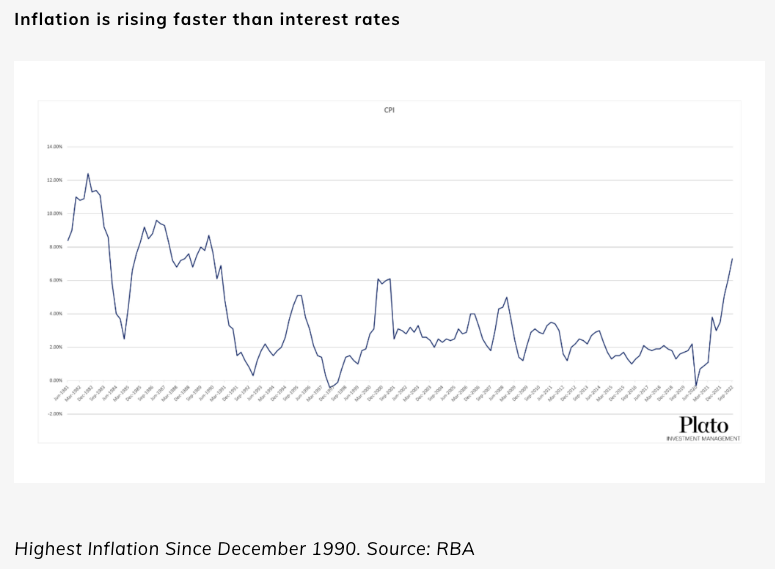

Safe assets now losing you money big time

The chart above demonstrates the 30+ year highs in inflation that we’ve experienced here in Australia since the onset of the COVID pandemic (discounting the GST effect period in 2000). In the September 2022 quarter, the CPI rose 7.3%.

This is significant for income investors, particularly retirees who generally see no wage growth to counter inflation because they simply rely on income from their investments to make ends meet.

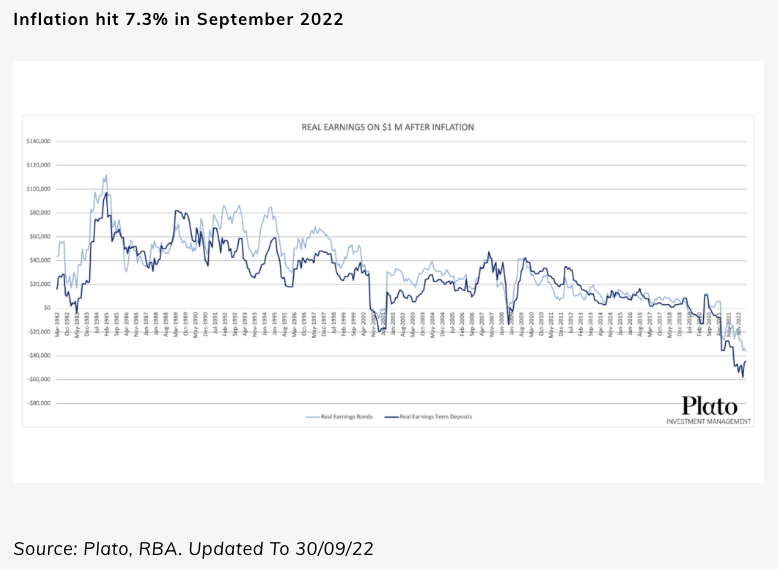

Below I highlight the real earnings of $1 million dollars invested in term deposits and bonds.

Despite much being said about the impact of rate rises on cash-backed asset classes, investors who rely on them continue to lose money in real terms.

Some things change, some remain the same

So, while a lot has changed over the past 12 months, much does remain the same.

Rising interest rates and inflation is a return to a dynamic that has always existed throughout the history of financial markets – an economic cycle.

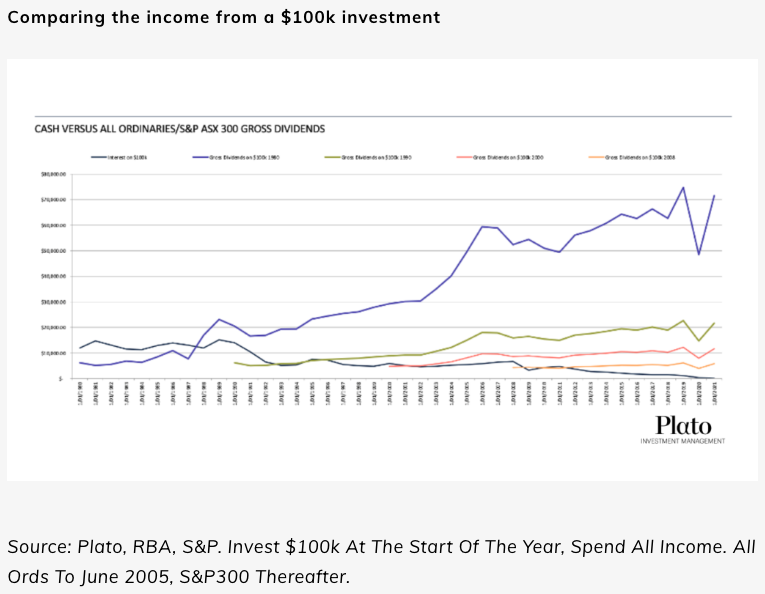

The current environment is very similar to 1994 which is when global interest rates went up, inflation spiked, and there was negative returns on bonds and negative returns on equity – but dividends kept rising.

This is illustrated below, where we chart the income generated from gross dividends on $100,000 invested in 1980 (light blue line).

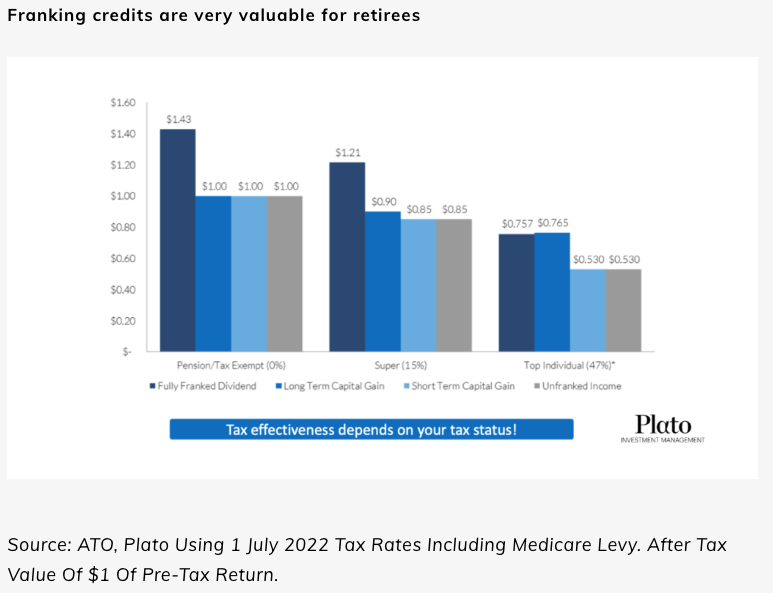

Franking credits are another retirement income sweetener that also hasn’t changed. For zero-tax investors a fully franked dividend is the most valuable form of income.

In the chart below you can see that for every one dollar of income received from fully franked dividends by pension-phase and other tax-exempt investors, an additional 43 cents on top in franking is received.

Favouring companies that pay fully franked dividends, where possible, in 2023 is a no-brainer.

And finally, the ability for active and nimble portfolio management to deliver greater income hasn’t changed.

At Plato we don’t ascribe to the traditional set-and-forget dividend investing strategy. We believe investors must move to where the dividends are flowing.

The energy and financials sectors are good examples of this. We’ve generated strong income over the past year from these sectors and remain positive on them for the year ahead. But for many years prior, they were poor performers for income investors.

Australian equity income in 2023

We think a number of companies in the resources and financials sectors are likely to continue to be strong and sustainable dividend payers into 2023.

Woodside Energy (ASX: WDS), BHP Group (ASX: BHP), and Macquarie Group (ASX: MQG) are are three examples.

However, it’s imperative investors avoid dividend traps – and there’ll be many to emerge in 2023. At Plato we believe avoiding dividend traps is just as important as identifying the strong and sustainable dividend payers. For some more insight, I spoke about some stocks we’ve identified as dividend traps in a recent Buy Hold Sell episode.

Plato’s modelling is projecting that at an index level in 2023 the ASX200 will deliver a cash yield of 4.4%, and 6.0% when including franking credits. On top of this, as high yield income fund managers, we think significant additional income can be generated through the benefits of active stock selection and tax-effective portfolio management.

So, we do think actively-managed Australian equities will continue to play a major role in helping to solve the retirement income conundrum in 2023. Particularly as term deposits, bonds and other so-called safe cash assets keep delivering negative real returns.

Disclaimer:

This document is prepared by Plato Investment Management Limited ABN 77 120 730 136, AFSL 504616 (‘Plato’). Pinnacle Funds Services Limited ABN 29 082 494 362, AFSL 238371 (‘PFSL’) is the product issuer of the Plato Australian Shares Income Fund (‘the Fund’). The Product Disclosure Statement (‘PDS’) of the Fund is available at https://plato.com.au/. Any potential investor should consider the relevant PDS before deciding whether to acquire, or continue to hold units in, a fund.

Plato and PFSL believe the information contained in this document is reliable, however no warranty is given as to its accuracy and persons relying on this information do so at their own risk. This communication is for general information only and was prepared for multiple distribution and does not take account of the specific investment objectives of individual recipients and it may not be appropriate in all circumstances. Persons relying on this information should do so in light of their specific investment objectives and financial situations. Any person considering action on the basis of this communication must seek individual advice relevant to their particular circumstances and investment objectives. Subject to any liability which cannot be excluded under the relevant laws, Plato and PFSL disclaim all liability to any person relying on the information contained in this communication in respect of any loss or damage (including consequential loss or damage), however caused, which may be suffered or arise directly or indirectly in respect of such information.

Any opinions or forecasts reflect the judgment and assumptions of Plato and its representatives on the basis of information at the date of publication and may later change without notice. Any projections contained in this presentation are estimates only and may not be realised in the future. The information is not intended as a securities recommendation or statement of opinion intended to influence a person or persons in making a decision in relation to investment. Past performance is not a reliable indicator of future performance.

Unauthorised use, copying, distribution, replication, posting, transmitting, publication, display, or reproduction in whole or in part of the information contained in this document is prohibited without obtaining prior written permission from Plato. Plato and their associates may have interests in financial products mentioned in the presentation.

Subscribe to our updates

Stay up to date with the latest news and insights from Pinnacle and our Affiliates.