PLATO INVESTMENT MANAGEMENT - FEBRUARY 2022

It’s Time To Assess Your Superannuation’s Carbon Footprint

By Plato Investment Management Managing Director, Dr Don Hamson

We now hear it from just about all corners of our industry – The Race To Net Zero Emissions Is An Investment Thematic That Can’t Be Ignored.

However, here in Australia (and many other parts of the world) investors can draw little confidence from the political environment.

Our government is willing to keep kicking the can down the road, begrudgingly agreeing to a net zero 2050 target with a pathway full of technological holes. The problem is 2050 is about 10 election cycles away.

So, we face a hugely-consequential economic transformation that’s not yet a priority for governments and oppositions.

Bigger than government

Despite the lack of political leadership, Australia is in fact doing reasonably well on the climate front. Emissions are falling at the total level, while emissions from electricity generation have halved from their peak. At one stage in September 2021, around 60% of Australia’s electricity demand was fulfilled by renewables.

But it is individuals and corporates responsible for this change, not governments. For families, not only does renewable energy make economic sense, but feeling good for our planet’s future is no doubt part of the motivation.

The same goes for corporates. Many of Australia’s largest companies (and largest emitters) have already adopted some very aggressive carbon reduction targets.

As an example, we recently met with Mineral Resources, which mines lithium and iron ore. Mineral Resources has scoped out over 80 Net Present Value positive projects that will help put it on its path to net zero by 2050, as it moves from a diesel-fueled mining company to a renewables-based electrified mining company.

Companies such as Amcor, CIMIC, Coles, RIO, Telstra and Woolworths have adopted targets of 50% or more carbon emissions reductions by 2030. Wesfarmers’ retail businesses (Bunnings, Kmart, Officeworks) are targeting net zero in 2030.

In some areas companies are literally falling over each other to make their businesses green. Aldi, Coles and Woolworths are all moving to 100% renewable electricity for their stores and distribution centres by 2025 or earlier. Charter Hall is looking for its buildings to go net zero by 2025, not 2050.

Overall, we estimate that approximately 75% of Australian ASX/S&P200 companies by market value have adopted net zero, carbon neutral or net positive carbon targets.

But a damaging carbon footprint remains in investment portfolios

Despite this positive progress, Australian and global companies have a long way to go.

Using Plato’s carbon database, we can assess the carbon footprint of leading investment indices. The chart below shows that if an investor placed $US1 million in an ASX/S&P200 index fund, the equity ownership share of those holdings was responsible for annual emissions of over 133 tonnes of carbon dioxide.

The Australian index is far more carbon intensive than the US or MSCI World markets, reflecting Australia’s industry mix, which is highly weighted to materials and energy stocks and relatively lowly weighted to information technology.

INDEX CARBON FOOTPRINT

As Of June 30, 2021. Source: Plato, FactSet, MSCI, Scope 1 And 2 Emissions.

Using this information, we can also estimate the carbon footprint of a typical superannuation investment.

According to the latest information from the ASFA’s superannuation statistics, we find that a typical couple aged 60-64 has assets worth around $650,000. Using just the average exposure to listed equities and property, we estimate this equates to approximately 28 tonnes of CO2 equivalent per annum in emissions through their equity ownership of company emissions.

This is larger than the average emissions of typical Australian household, which sits at around 15-20 tonnes.

For perspective, 28 tonnes is equivalent to 63 return Sydney-Melbourne economy flights, 2.8 return economy flights Sydney-London, or 8.4 medium petrol cars driving around 12,000 kilometres per year.

Unlocking a ‘net zero now’ investment portfolio?

Plato has been able to achieve a net zero carbon footprint without using costly carbon credits in the portfolio of our Plato Global Net Zero Hedge Fund. This is through a combination of shorting high carbon emitting global stocks and going long stocks with below average carbon footprints.

There are also a growing number of other low carbon investment alternatives rapidly emerging in the broader listed and unlisted managed funds space.

Why? The sceptics might argue it’s opportunistic, but like the families and corporates, investors (and many investment managers) are growing more and more carbon conscious and the economics are growing more and more attractive.

An insight into the European market illustrates this, and perhaps provides an insight into why going ‘net zero now’ could be so lucrative for investors in the years ahead. Europe is the most advanced economic block when it comes to decarbonisation, so it provides a strong indication of what’s to come for the laggard economies, such as Australia.

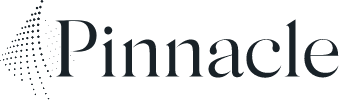

You can see above (left of page), European capital has dominated flows into sustainable funds since 2018. The rest of the world remains markedly behind.

This is no surprise when comparing performance of high carbon intensity stocks versus low carbon intensity stocks in Europe after controlling for sectors. Right of page we see that in Europe high carbon intensity stocks within a sector have underperformed low carbon intensity stocks by cumulative more than 30%.

Remember, Europe has had a price on carbon since 2005. In a regulatory sense it is the most developed market globally when it comes to decarbonisation. This, along with the aforementioned proliferation of flows into sustainable funds has led to that significant outperformance seen by low carbon intensity stocks.

We compare this to the US (light green line) and there is little different between the performance of high carbon and low carbon stocks. However, the rest of the world has no choice but to catch up and we believe a similar market dynamic to what’s occurred in Europe will likely play out across the globe in the years ahead.

Action begins at home

Regardless of what our politicians do, the buck stops with all of us to help limit climate change. When a company or an individual makes an investment decision, be it for a new mine or office building or a new house or car, or even a new appliance, that decision is locking in future emissions for many years.

Indeed, we think the race to net zero will be the most important thematic for investment returns over the next 30 years, but we think the time to reach net zero in your investment portfolio can be now.

Disclaimer:

This document is prepared by Plato Investment Management Limited ABN 77 120 730 136, AFSL 504616 (‘Plato’). Pinnacle Funds Services Limited ABN 29 082 494 362, AFSL 238371 (‘PFSL’) is the product issuer of the Plato Australian Shares Income Fund (‘the Fund’). The Product Disclosure Statement (‘PDS’) of the Fund is available at https://plato.com.au/. Any potential investor should consider the relevant PDS before deciding whether to acquire, or continue to hold units in, a fund.

Plato and PFSL believe the information contained in this document is reliable, however no warranty is given as to its accuracy and persons relying on this information do so at their own risk. This communication is for general information only and was prepared for multiple distribution and does not take account of the specific investment objectives of individual recipients and it may not be appropriate in all circumstances. Persons relying on this information should do so in light of their specific investment objectives and financial situations. Any person considering action on the basis of this communication must seek individual advice relevant to their particular circumstances and investment objectives. Subject to any liability which cannot be excluded under the relevant laws, Plato and PFSL disclaim all liability to any person relying on the information contained in this communication in respect of any loss or damage (including consequential loss or damage), however caused, which may be suffered or arise directly or indirectly in respect of such information.

Any opinions or forecasts reflect the judgment and assumptions of Plato and its representatives on the basis of information at the date of publication and may later change without notice. Any projections contained in this presentation are estimates only and may not be realised in the future. The information is not intended as a securities recommendation or statement of opinion intended to influence a person or persons in making a decision in relation to investment. Past performance is not a reliable indicator of future performance.

Unauthorised use, copying, distribution, replication, posting, transmitting, publication, display, or reproduction in whole or in part of the information contained in this document is prohibited without obtaining prior written permission from Plato. Plato and their associates may have interests in financial products mentioned in the presentation.

Subscribe to our updates

Stay up to date with the latest news and insights from Pinnacle and our Affiliates.