HYPERION ASSET MANAGEMENT - JULY 2022

Selling the Future to Buy the Past – Short Termism at its Worst

By Mark Arnold (Hyperion CIO) and Jason Orthman (Hyperion Deputy CIO)

Over the past eight months, we have seen a significant rotation out of long duration, high quality, structural growth companies into lower quality, lower duration, “old world” cyclical businesses.

We think there are two key reasons for this rotation and the underperformance of high-quality structural growth stocks over recent months:

- There has been a significant increase in long-term government bond yields over a very short time period. This has adversely impacted the short-term market prices of all long duration assets, including high quality structural growth stocks; and

- There has been an “abundance” of nominal economic growth as the world has experienced a rapid cyclical recovery from the COVID-19 crisis.

We expect both factors to be temporary in nature and reverse in the future

In the short-term, market valuations of high quality, structural growth stocks tend to be heavily influenced by significant changes in long-term bond yields. This is only a short-term influencing factor because these changes in bond yields tend to be range bound, mean reverting and amortising. That is, most changes in bond yields tend to reverse over time and their influence on stock returns does not compound, it amortises. This means the longer the time period, the less influence changes in bond yields and discount rates have on stock prices. Over the long run, it is the compounding effect of sustained earnings growth that dominates share price returns, not changes in bond yields. Furthermore, high quality, structural growth stocks tend to have strong pricing power that enable them to offset any negative impact of higher inflation and interest rates on valuation multiples by being able to retain the real (after inflation) value of their future free cash flows.

Lower quality stocks have been more attractive to buy in the short run because their revenue and earnings are more sensitive to, and benefit more, from higher levels of economic growth compared with structural growth stocks. These types of lower quality stocks only grow when the economy is growing and/or inflation is high. In a low growth and low inflation environment these businesses only produce low levels of underlying earnings growth. That is, the earnings and stock prices of these lower quality stocks are extremely sensitive to the level of economic growth (in nominal terms) and thus these stocks have benefited from the strong cyclical recovery following the COVID-19 crisis. The major stock market indices are dominated by these lower quality, “old world” stocks.

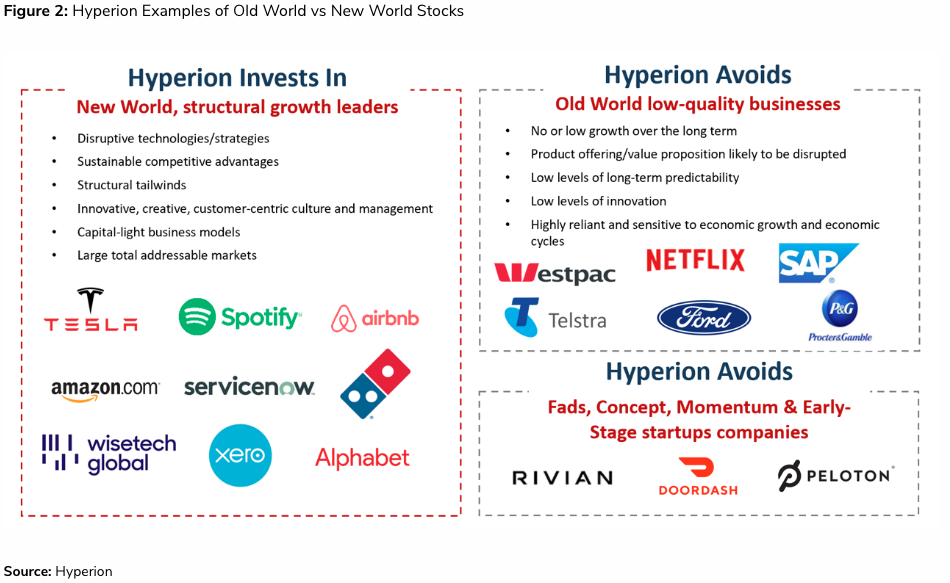

Selling the future to buy the past

We believe market participants are in effect “selling the future to buy the past”. Capital allocators are also failing to adequately distinguish between quality, structural growth companies and concept, momentum growth companies. We believe unless you can identify the market winner and quantify the underlying economics of the business long term, you are speculating, not investing.

Despite the recent underperformance, we believe the long run fundamental risk associated with high quality, structural growth companies is relatively low and these stocks should lead the market higher once the current period of “growth abundance” passes. We believe it is likely that nominal gross domestic product (GDP) growth will slow over the next 12 months and as this slowing occurs, capital allocators are likely to switch back towards structural growth stocks.

At the same time, as nominal GDP growth slows, long-term bond yields should also decline, providing a one-off tailwind to long duration assets including high quality structural growth stocks. A future reduction in long-term bond yields would involve a reversal of the duration impact that has negatively influenced structural growth stocks in recent months.

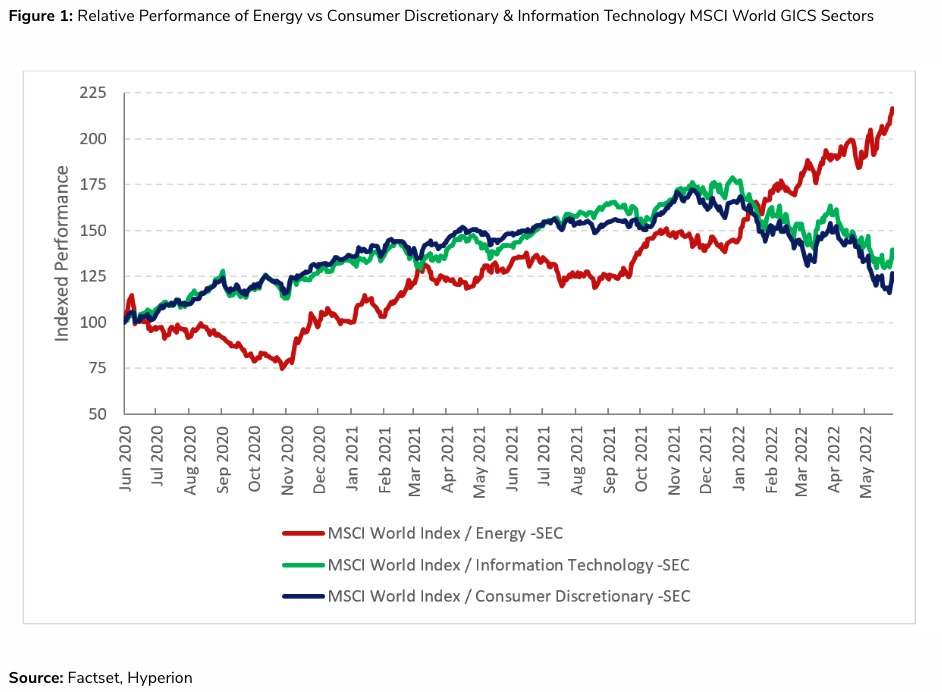

The rotation from growth to energy and value stocks has intensified over the first six months of calendar year 2022. Capital allocators have been switching to lower quality, cyclical businesses as short-term nominal GDP growth has been elevated. The high growth environment, a by-product of the COVID-19 economic recovery, has reduced the relative attractiveness of what we believe to be high quality, structural growth stocks, like the companies in Hyperion’s portfolios. The rotation is highlighted in the chart below which shows the short-term relative out-performance of the global Energy sector versus the Consumer Discretionary and Information Technology sectors.

Capital allocators have been able to achieve exposure to high short-term earnings growth through purchasing stocks which are typically lower quality, low duration, cyclical, and value style. Lower quality or “old world” stocks (those businesses that are being disrupted by a far superior product or service) have enjoyed higher earnings per share growth over the last 12 months because they are highly sensitive to changes in nominal GDP growth. However, we believe that this earnings growth is low quality as it is cyclical and therefore transitory in nature with nominal earnings growth significantly boosted by high inflation.

We do not think it is likely that the tailwinds from strong nominal GDP growth will continue for lower quality, cyclical and value stocks. Underlying demand remains low and global growth is slowing. In fact, the World Bank updated its real GDP growth forecasts for advanced economies to 2.6% in 2022, down from 5.1% in 2021, before moderating to 2.2% in 20231. We believe a recession may be difficult to avoid for many countries. Of course, the extent and duration of any recession, technical or otherwise is unknown.

If a global recession eventuates, our base case is that it is relatively shallow as we believe the financial system remains functional, unlike throughout the GFC. In a recessionary environment, demand typically evaporates in the short term. This tends to be a negative force on average businesses that are sensitive to broader economic conditions. It would be difficult to see commodity prices remaining at elevated levels if demand weakens considerably for end users. However, if there is a period of sustained high inflation despite slower global growth, low-quality, old-world businesses will suffer the most because ultimately many will be unable to pass higher input costs to their customers.

A long-term investment horizon

Rather than being fundamentally driven, we believe that the sharp sell-off in high quality, structural growth stocks has been largely driven by short-term macroeconomic factors, contagion, and fear. The recent reporting seasons have been consistent with our longer-term earnings expectations and valuations. We think the current decline in the prices of our portfolio companies presents an attractive opportunity for people with long-term investment horizons. Recent market behaviour has confirmed our view that there is a lack of business analysis, conviction and long-termism in equity markets. Market flows are dominated by passive and quantitative allocators whose short-term focus has been on the duration of stocks and their sensitivity to sudden changes in long-term bond yields.

At Hyperion, we constantly test our investment thesis to check how we could be wrong in the longer term. We think the new world businesses we own are transforming industries. They are typically disrupting incumbent businesses through innovation and by creating products that are significantly better and/or cheaper than existing products offered by their competitors.

The new world businesses in Hyperion’s portfolios will likely be able to produce high sustained relative growth rates in the long run by expanding into large addressable markets and sustaining their innovative cultures. These businesses also have the ability to take market share and increase prices without impacting their value proposition. In fact, we expect market share shifts to accelerate through economic downturns due to consumers becoming more discerning when they are under financial pressure. Quality structural growth companies, like those in Hyperion’s portfolios, are typically less sensitive to broader economic conditions.

1 World Bank GDP growth forecasts dated 07/06/2022. Figures from Table 1.1 of the Global Economic Prospects Report. Source: World Bank, 2022.

The world has begun to modernise and digitise at a rapid rate over the last three to five years. Consumers are streaming more, using eCommerce and smartphones, making digital payments and using software more in business and in their personal lives. In our view, the only way we could be wrong is if the world reverts to an analogue world. Hyperion views the next generation as “digital natives” as they have grown up in a modern, digital world. It would be unlikely for them to reverse course and decide to behave like the generations before them, and in effect, sell the future to buy the past.

Disclaimer:

Hyperion Asset Management Limited (‘Hyperion’) ABN 80 080 135 897, AFSL 238 380 is the investment manager of the Funds. Please read the Product Disclosure Statement (‘PDS’) in its entirety before making an investment decision in the Funds. You can obtain a copy of the latest PDS of the Funds by contacting Hyperion at 1300 497 374 or via email to investorservices@hyperion.com.au.

The fund changed its name from Hyperion Global Growth Companies Fund – Class B to Hyperion Global Growth Companies Fund (Managed Fund) on 5 February 2021 in order to facilitate quotation of the fund on the ASX.

Hyperion and Pinnacle Fund Services Limited believes the information contained in this communication is reliable, however no warranty is given as to its accuracy and persons relying on this information do so at their own risk.

Any opinions or forecasts reflect the judgment and assumptions of Hyperion and its representatives on the basis of information at the date of publication and may later change without notice. The information is not intended as a securities recommendation or statement of opinion intended to influence a person or persons in making a decision in relation to investment. This communication is for general information only. It has been prepared without taking account of any person’s objectives, financial situation or needs. Any person relying on this information should obtain professional advice before doing so. To the extent permitted by law, Hyperion disclaim all liability to any person relying on the information in respect of any loss or damage (including consequential loss or damage) however caused, which may be suffered or arise directly or indirectly in respect of such information contained in this communication.

Subscribe to our updates

Stay up to date with the latest news and insights from Pinnacle and our Affiliates.